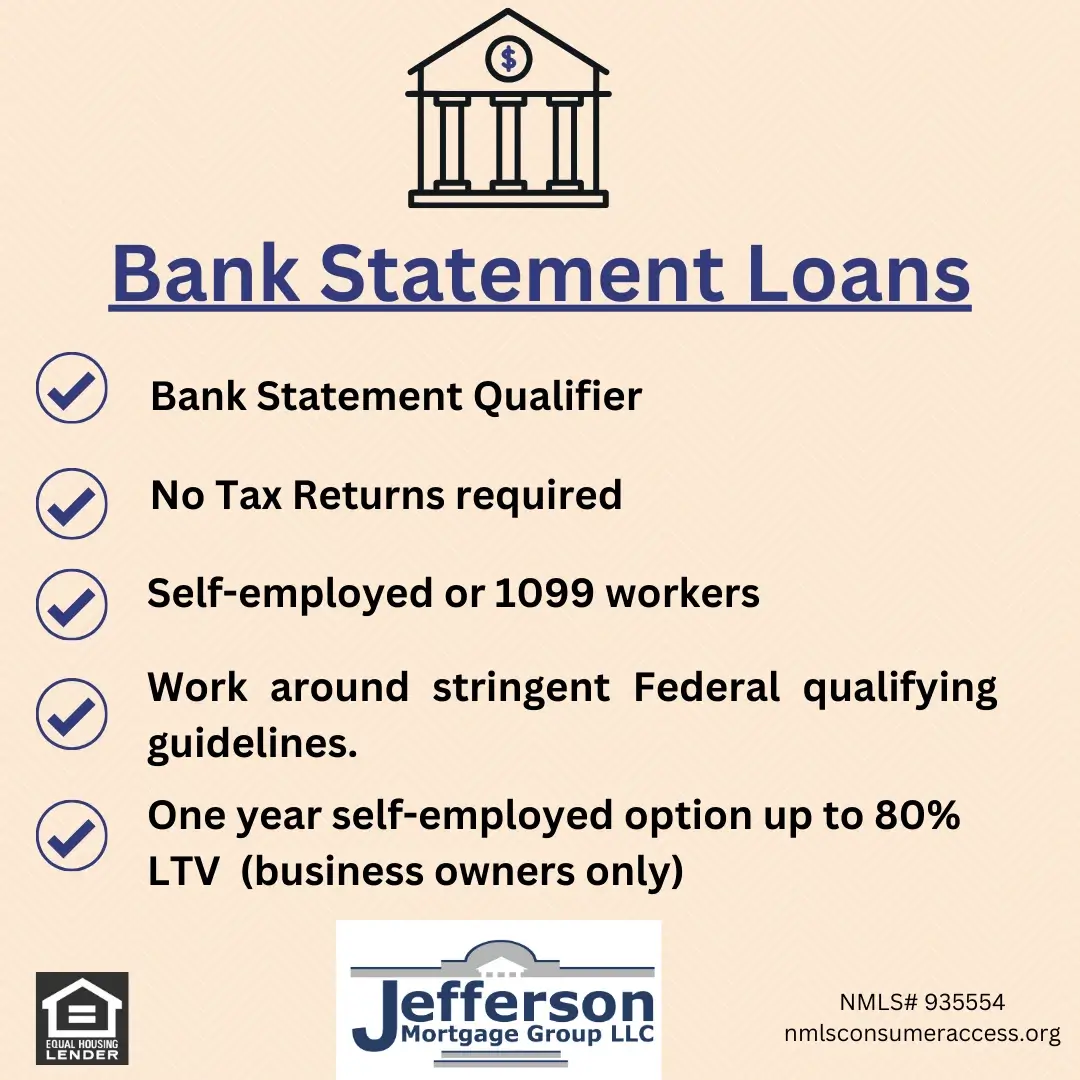

What do these Bank Statement programs do and how do they work? These programs represent a work-around of the stringent Federal “Ability to Repay” (ATR) rules that govern standard full documentation qualifying guidelines. This program is

Feb 26, 2024 | self-employed borrower bank statement loan

If you are a self-employed business owner or a 1099 worker qualifying for an owner-occupied loan can be difficult. You pay your accountant and after all of your expenses you either show a business loss or insufficient income to qualify. It would seem th

Jul 14, 2022 | Jefferson Mortgage Group self-employed borrower bank statement loan cashflow

Over my entire career in the mortgage field, self-employed borrowers always stand out as the more challenging opportunities. The self-employed borrower often finds themselves in a tug of war between their accountant’s guidance and the demands of the mort

Nov 09, 2018 | Mortgage Loan Process Specialized Forward Mortgages Non QM QM self-employed borrower bank statement loan mortgage

It is true that the Self Employed borrower normally hits a wall when it comes to qualifying for a mortgage when asked for their Federal tax returns. The process by which your accountant works their magic is the often the exact opposite of what the lenders

Apr 19, 2018 | Traditional Mortgage Mortgage Loan Process Age in Place Specialized Forward Mortgages self-employed borrower bank statement loan cashflow Business Cash-flow