Headline inflation has hit us all mainly at the gas pump and the food store, but it’s everywhere and the adverse effects are more prevalent amongst people that live and depend on fixed income. HECM Reverse Mortgage endorsements had their best year in 202

Apr 11, 2022 | Reverse Mortgage Retirement Planning supplemental retirement income Retirement income insecurity HECM Reverse Mortgage lifetime income with a Reverse Eligibility for Reverse Mortgage Age in Place Jefferson Mortgage Group Inflation cashflow

What does this mean for you? A higher limit will accommodate higher home prices and allow for higher home equity access across the board for all eligible age groups going forward. Higher equity access means the HECM has become a more flexible tool for re

Jan 26, 2021 | Reverse Mortgage HECM Reverse Mortgage Seniors reverse credit line Eligibility for Reverse Mortgage Age in Place HECM Changes 2021 Changes

Getting a Reverse Mortgage for a homeowner with an unrestricted approval versus a restricted approval due to credit problems, even some that are very minor, can often be challenging. The program has become much stricter regarding credit incidents since th

Oct 13, 2020 | Reverse Mortgage Retirement Planning HECM Reverse Mortgage Seniors Age in Place HECM Changes Unrestricted Approval success story

How are mom and dad doing during the pandemic? Hopefully they are home and staying safe. It’s not like everybody isn’t stressed enough by the current situation. It is clearly affecting everyone. As for older people, one of the other less talked about si

Jun 23, 2020 | Reverse Mortgage Seniors Age in Place Senior Advocate Jumbo Reverse Mortgage

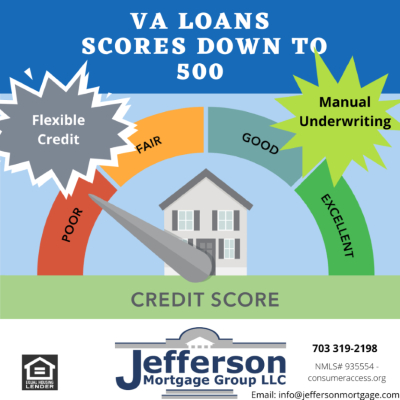

Most veterans are relegated out of the VA Loan Program by the marketplace for having lower credit scores and credit related issues. Many lenders shy away from VA borrowers with less than 620 credit scores and others have instituted underwriting overlays

Mar 03, 2020 | mortgage VA Low Score VA LOAN manual underwrite

Low interest rates have, in one perspective, liberated older homeowners by giving them many choices to stay in their family homes with Jumbo Reverse Mortgages. Some of the choices may include paying off existing mortgages and other debt, adding liquidity

Oct 16, 2019 | supplemental retirement income Age in Place downsizing Jumbo Reverse Mortgage 55+ High-Value Homes