Reverse Mortgages, whether discussing the HECM Government Insured or the Private Label Jumbo for higher priced homes, have not gotten any easier although the new tax bill that just took effect holds some promise. Since the 2017 major industry program chan

Jan 07, 2026 | Reverse Mortgage HECM Reverse Mortgage Residual Income OBBBA

Reverse Mortgages have gotten tougher to qualify for over the past several years. They used to primarily be an entitlement based on the youngest borrower’s age and the value of the home. Due to additional strict guidelines, they are no longer an ent

Nov 10, 2025 | Reverse Mortgage Retirement Planning HECM Reverse Mortgage Eligibility for Reverse Mortgage

Buying investment properties can be costly and risky. What makes the most practical sense when you consider costs and risk associated with a project? Buying a property with an existing structure and rehabbing it often makes the most sense. Ground up const

Nov 07, 2025 | Non QM Investor Loans Real Estate Investment Loans DSCR

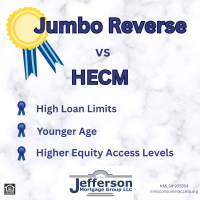

The Jumbo Reverse has clearly become an avid competitor in the Reverse Mortgage market with offerings of high loan limits, younger age thresholds, and higher equity access levels as compared to government insured options. The Jumbo Reverse will allow borr

Sep 03, 2025 | HECM Reverse Mortgage private label reverse mortgage Jumbo Reverse Mortgage

Reverse Mortgages have broad application for retirees and seniors depending on the current health of the applicant. For those that are generally healthy and desire to stay in their home, the likely strategy for adding a reverse mortgage would be increasin

Mar 19, 2025 | Reverse Mortgage supplemental retirement income Age in Place cashflow

Have you ever considered a HELOC? This new program is now available for loan amounts up to $750,000, which is much higher than the traditional banking loan limit cap of $250,000-$400,000. Our HELOCs can be established as first trust mortgages

Feb 18, 2025 | DSCR HELOC 2025 changes