Reverse Mortgages, whether discussing the HECM Government Insured or the Private Label Jumbo for higher priced homes, have not gotten any easier although the new tax bill that just took effect holds some promise. Since the 2017 major industry program chan

Jan 07, 2026 | Reverse Mortgage HECM Reverse Mortgage Residual Income OBBBA

Reverse Mortgages have gotten tougher to qualify for over the past several years. They used to primarily be an entitlement based on the youngest borrower’s age and the value of the home. Due to additional strict guidelines, they are no longer an ent

Nov 10, 2025 | Reverse Mortgage Retirement Planning HECM Reverse Mortgage Eligibility for Reverse Mortgage

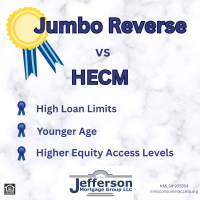

The Jumbo Reverse has clearly become an avid competitor in the Reverse Mortgage market with offerings of high loan limits, younger age thresholds, and higher equity access levels as compared to government insured options. The Jumbo Reverse will allow borr

Sep 03, 2025 | HECM Reverse Mortgage private label reverse mortgage Jumbo Reverse Mortgage

• HECM Reverse Mortgages (Government Insured FHA): $1,149,825 • Jumbo Reverse (Private Label): $4,000,000 (higher loan amounts require exceptions based on market conditions) • Jumbo Reverse-Standalone Second Trusts: $4,000,000

Jan 09, 2024 | Reverse Mortgage HECM Reverse Mortgage Jumbo Reverse Mortgage VA Low Score VA LOAN Lending Limit increase Jumbo Reverse Second Trust

Headline inflation has hit us all mainly at the gas pump and the food store, but it’s everywhere and the adverse effects are more prevalent amongst people that live and depend on fixed income. HECM Reverse Mortgage endorsements had their best year in 202

Apr 11, 2022 | Reverse Mortgage Retirement Planning supplemental retirement income Retirement income insecurity HECM Reverse Mortgage lifetime income with a Reverse Eligibility for Reverse Mortgage Age in Place Jefferson Mortgage Group Inflation cashflow

What does this mean for you? A higher limit will accommodate higher home prices and allow for higher home equity access across the board for all eligible age groups going forward. Higher equity access means the HECM has become a more flexible tool for re

Jan 26, 2021 | Reverse Mortgage HECM Reverse Mortgage Seniors reverse credit line Eligibility for Reverse Mortgage Age in Place HECM Changes 2021 Changes